when is tax season 2022 canada

Let us help you get started. Please be reminded that this is the US tax filing deadline.

Essential Tax Numbers Updated For 2022 Advisor S Edge

Having the information you need on hand to file your return makes the filing process that much easier.

. To avoid follow-up queries it may make sense to highlight this. Mark your calendar The deadline for most Canadians to file their federal income tax and benefit return for their 2021 taxes is April 30 2022. Tax Filing Deadline for Individual Tax Returns.

Installment payment for individuals. Non-resident tax return deadline. If April 30 falls on a weekend the CRA extends the deadline to the following business day.

However you dont have to wait until April to file your Canadian tax return. We know that we have many commercials we share etc with the US so be mindful that many of these commercials state the deadline as. Because April 30 is a Saturday and the CRA isnt that draconian the tax deadline for 2022 is May 2.

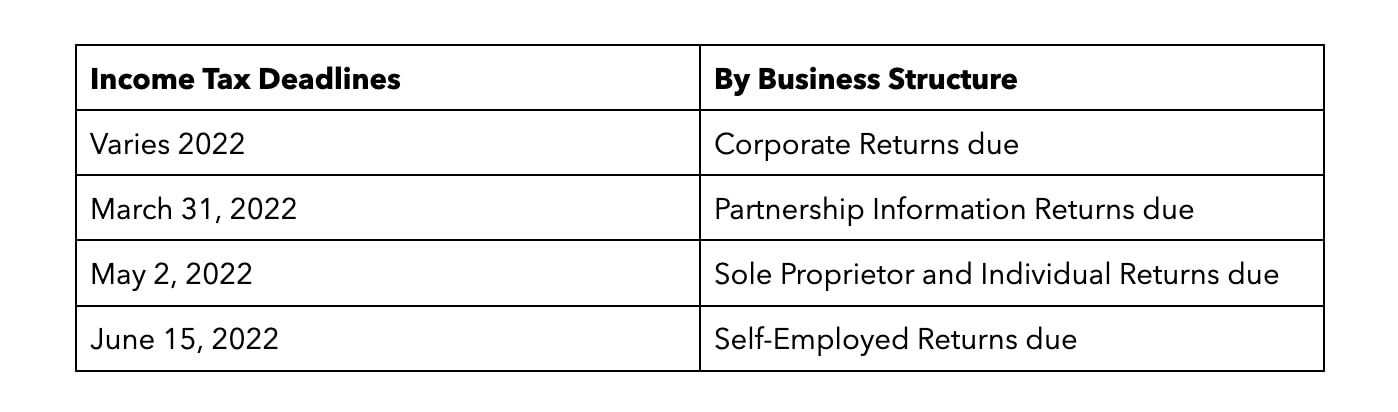

File your return by the deadline. The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. Corporation Income Tax Return.

Your return can also be postmarked on or before May 2 for it to be considered on time. 01 January 2022 First Day Of New Tax Year. In 2022 the RRSP dollar limit increased to 29210.

The RRSP annual dollar limit for tax year 2021 is 27830. Remember that your RRSP contribution limit is capped at 18 of your earned income in the previous year. Tax Changes in 2022.

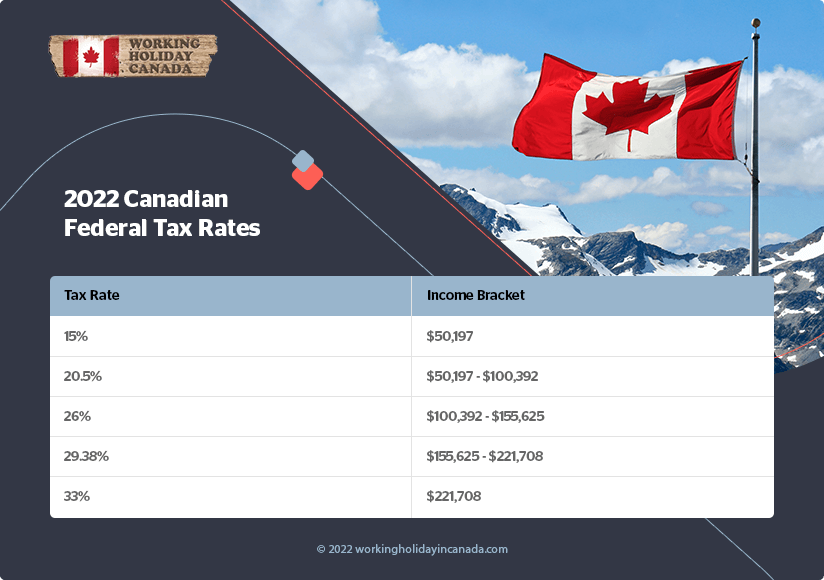

The federal income tax brackets increased in 2022 based on an indexation rate of 24. To give the CRA enough time to develop the new system payments would start in July 2022 with a double-up payment covering the two quarters beginning April and July 2022. The 2022 tax filing season in canada has kicked off on february 21 2022.

This means the dollar limit is the maximum amount you can contribute regardless of your income. April 30 2022 extended to May 2 nd Tax filing deadline for self-employed individuals. The CRA increased BPA by 590 to 14398 for 2022 on which the minimum federal tax rate of 15 wont apply.

The internal revenue service announced that the nations tax season will start on monday january 24 2022 when the tax agency will begin accepting and processing 2021 tax year returns. The basic personal amount is up to 14398. Rest assured that turbotax will be available when you need it to file your 2021.

Let us help you get started. What you need to know for the 2022 tax-filing season. The canada annual tax calculator is updated for the 202223 tax year.

Many people still think that their returns are due by April 15. CRAs Dawn Kennedy joins us with tax filing tips whats new this tax filing season and what you need to know if you received COVID-19 benefits. You can prepare your return as soon as you receive all the necessary slips and paperworksuch as T4s T4As T5s T3s and RRSP receiptsfrom your employers banks government agencies etc.

Mark your calendar The deadline for most Canadians to file their income tax and benefit return for their 2021 taxes is April 30 2022. You can file before this date and get ahead of the queue. May 2 2022 or June 15 2022 if a spouse is self-employed.

Because this date is a Saturday your return will be considered filed on time if the CRA receives it or it is postmarked on or before May 2 2022. We receive it on or before May 2 2022. We want to help you get ready so you are in good shape when it.

Because this date is a Saturday your return will be considered filed on time if the CRA receives it or it is postmarked on or before May 2 2022. The deadline for filing a tax return for the 2021 tax year is 2 May 2022. June 15 2022.

If you are looking to file your tax return electronically you must have your personal tax return in by midnight on May 2 2022. The tax filing deadline for your 2021 tax return is May 2 2022. Federal Tax Rate Brackets in 2022.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. Find the answers you need for the 2022 tax-filing season. This falls on a Saturday so as long as the CRA receives the return on or before May 2 it is considered on time.

March 15 June 15 September 15 and December 15. Feb 22 2022. To avoid being late be sure you file your taxes on or by May 2.

Last-minute tax-filing tips to help you. Last year Canadians filed almost 31 million income tax and benefit returns. The deadline for most canadians to file their income tax and benefit return is april 30 2022.

For the 2022 tax season in Canada the deadline is April 30 2022. Since April 30 2022 falls on a Saturday your income tax and benefit return will be considered filed on time in either of the following situations. Filing deadline for most individuals is April 30 2022.

February 21 2022 is the earliest date for filing tax returns via computer. This will save you 2160 15 of 14398 in the federal tax bill provided your. Tax season in Canada starts early with forms and publications for the 2021 tax year available to view download and order from the CRA website as of January 18 2022.

Canadian tax payers may file their income tax by april 30 2022. Protect yourself from scams and fraud know what to expect from the CRA. If you or your partner is self-employed but the deadline to pay is still May 2 2022.

Because April 30 our usual tax deadline falls on a Saturday The CRA will extend the deadline to the next business day which will be May 2 2022.

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Updated For 2022 Your Guide To Taxes In Toronto Canada

What Could Be In The Federal Budget Wolters Kluwer

Canadian Tax Return Deadlines Stern Cohen

How To File Income Tax Return To Get Refund In Canada 2022

7 Best Free Tax Return Software For Canadians 2022 Savvy New Canadians

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Updated For 2022 The Basics Of Tax In Canada

Updated For 2022 Your Detailed Guide To Taxes In Vancouver Canada

2022 Tax Deadlines Canada When Are Corporate And Personal Taxes Due Blog Avalon Accounting

How To File Income Tax Return To Get Refund In Canada 2022

How To File Income Tax Return To Get Refund In Canada 2022

When Are Small Business Taxes Due Quickbooks Canada

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

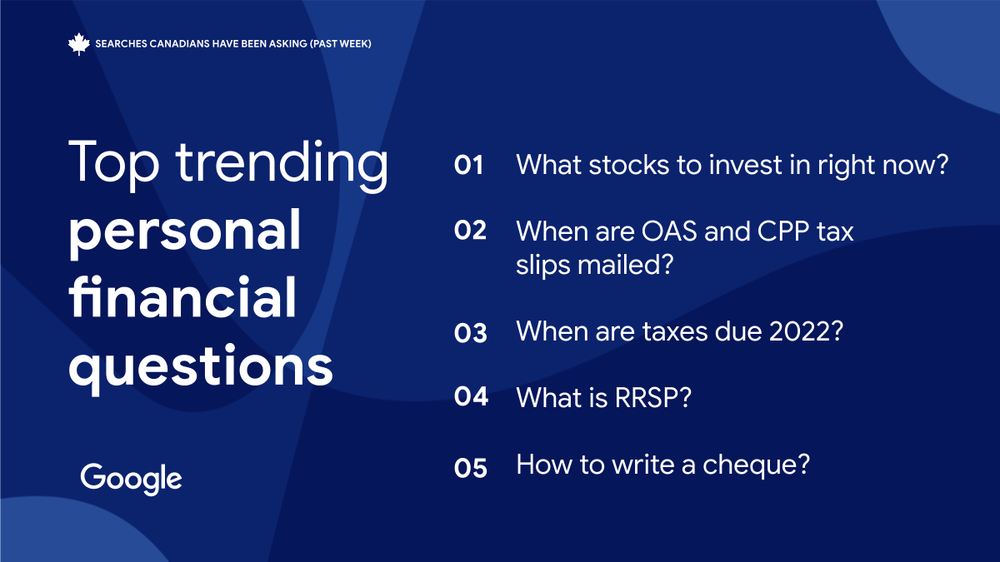

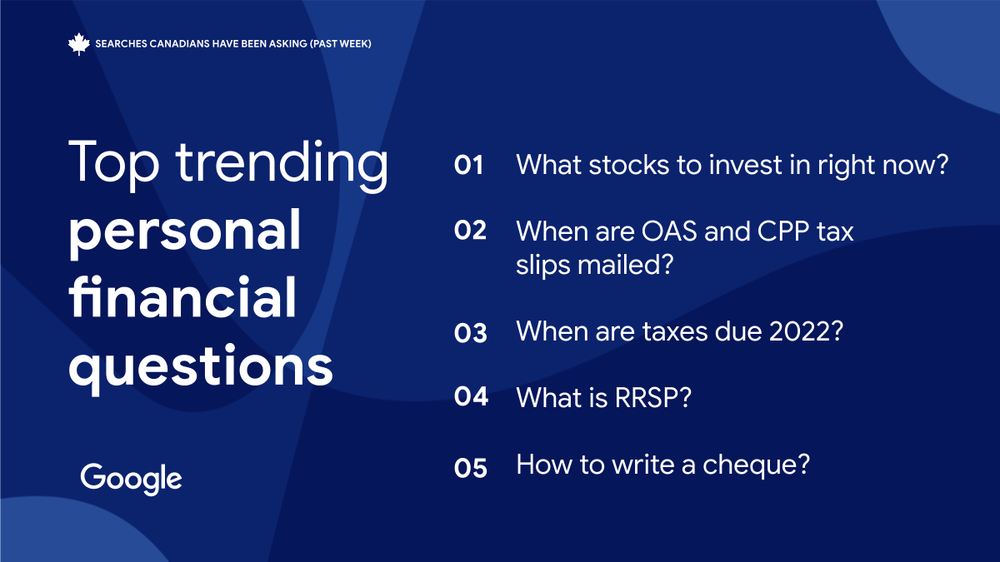

Google Trends Show Personal Finances Are A Top Priority For Canadians In 2022

Updated For 2022 The Basics Of Tax In Canada

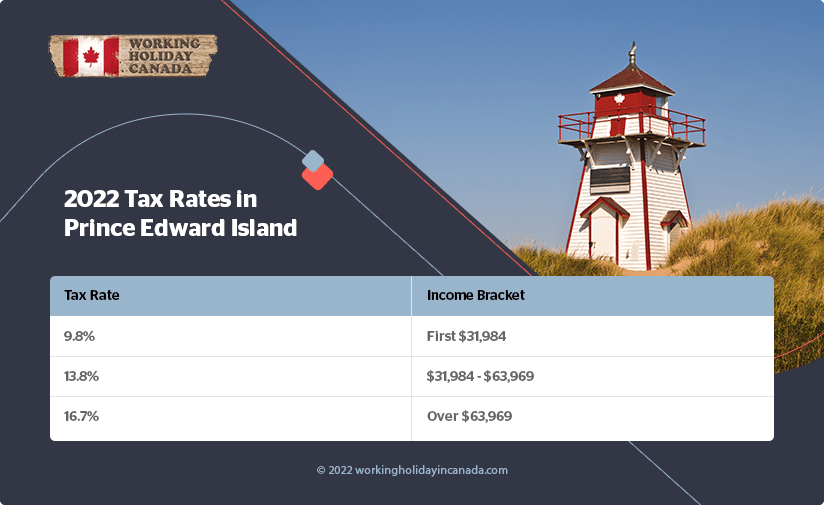

Marginal Tax Vs Average Tax Understanding Canadian Tax Brackets